The new year is upon us, and we’ve got questions: Is Paramount’s chair Shari Redstone ready to make a deal? Will Warner Bros. Discovery CEO David Zaslav finally find his footing? Will Disney’s Bob Iger dig himself out of the company’s troubles and name a successor? How will Netflix’s data reveal affect its relationship with creatives? And, what lies ahead of mega-agencies CAA and Endeavor?

What will 2024 hold for these companies and their CEOs? Kim Masters teams up again with Puck News’ Matt Belloni and Bloomberg’s Lucas Shaw to read the town’s tea leaves for the year ahead in this special Megabanter.

More: A look back at Hollywood’s rollercoaster 2023

Shari Redstone and Paramount

The biggest predicament moving in the new year lies with executive Shari Redsone and her company Paramount Global’s struggles.

Why is Paramount struggling? Masters believes Redstone has to accept that “the world has changed” and that she can not run the company like her father, Sumner Redstone, who died in 2020.

“Even if she were the best executive in the universe, and history, it's just a struggle for a legacy company right now,” Masters says. “Paramount [and its] dependency on cable channels that don't really register anymore, it's like high up on that list.”

Is Redsone ready to deal? “You've heard from people close to her, at this point a year or two, that she was open to doing deals,” Shaw says.

On December 19, Paramount Global’s CEO Bob Bakish held informal talks on December 19 with Warner Bros. Discovery’s head David Zaslav about a possible merger.

What are her main challenges? Finding a buyer has been difficult because Paramount’s financials continue to decline and most people are interested in buying pieces of it.

“The only real buyer for those cable networks would be private equity firms, and with interest rates and the cost of raising money and all those things, they just might not want to do that deal,” Shaw notes.

The same week when Paramount and WBD met, media mogul Byron Allen resubmitted a $3.5 billion offer to acquire BET Media Group from Redstone’s National Amusements, which controls Paramount Global (formerly ViacomCBS) and owns BET, Paramount Pictures, CBS, Comedy Central, Showtime Networks, Nickelodeon, and MTV.

“So you have a lot of folks who can just sit and watch this thing, circle the drain and get it at a discount price,” Shaw adds.

At what point does she take any offer? “That point is now!” says Belloni. “Do whatever you can get the most money and let someone else deal with these problems.”

Twenty years ago, Belloni notes, “Viacom was the most valuable company,” but a lot has happened since. Now, it’s “the smallest of the legacy media companies.”

“We are in an age of consolidation:” Looking at what happened to the legacy of Fox when it merged with Disney, Masters worries about what’s to come. “Now it's going to be Paramount. Gone,” she says. “We've got others that might vanish, and Hollywood is transforming before our eyes. It is kind of sad.”

Shaw hopes that Paramount retains its name, regardless of what happens to the company. “Paramount, I feel, along with Warner Bros. are sort of the two movie studios that mean the most to people.”

MORE: A look back at Hollywood’s rollercoaster year

Warner Bros. Discovery and David Zaslav

After a rollercoaster year, WBD’s CEO David Zaslav might start seeing some changes in the Spring.

Will WBD’s CEO find his footing? Belloni says Zaslav will have to wait until April 2024 to close any deals. That’s when the Reverse Morris Trust (RMT) expires. John Malone, a key shareholder at WBD, aspired to combine assets with either Paramount, Comcast or NBCUniversal to make WBD “bigger, more powerful.”

“I think next year, we'll probably see at least an announcement of some exploration if not an actual deal,” Belloni adds.

Shaw is not so convinced. He suspects that “there will be a lot of smoke,” unless the Paramount or NBCUniversal-Comcast deal really happens.

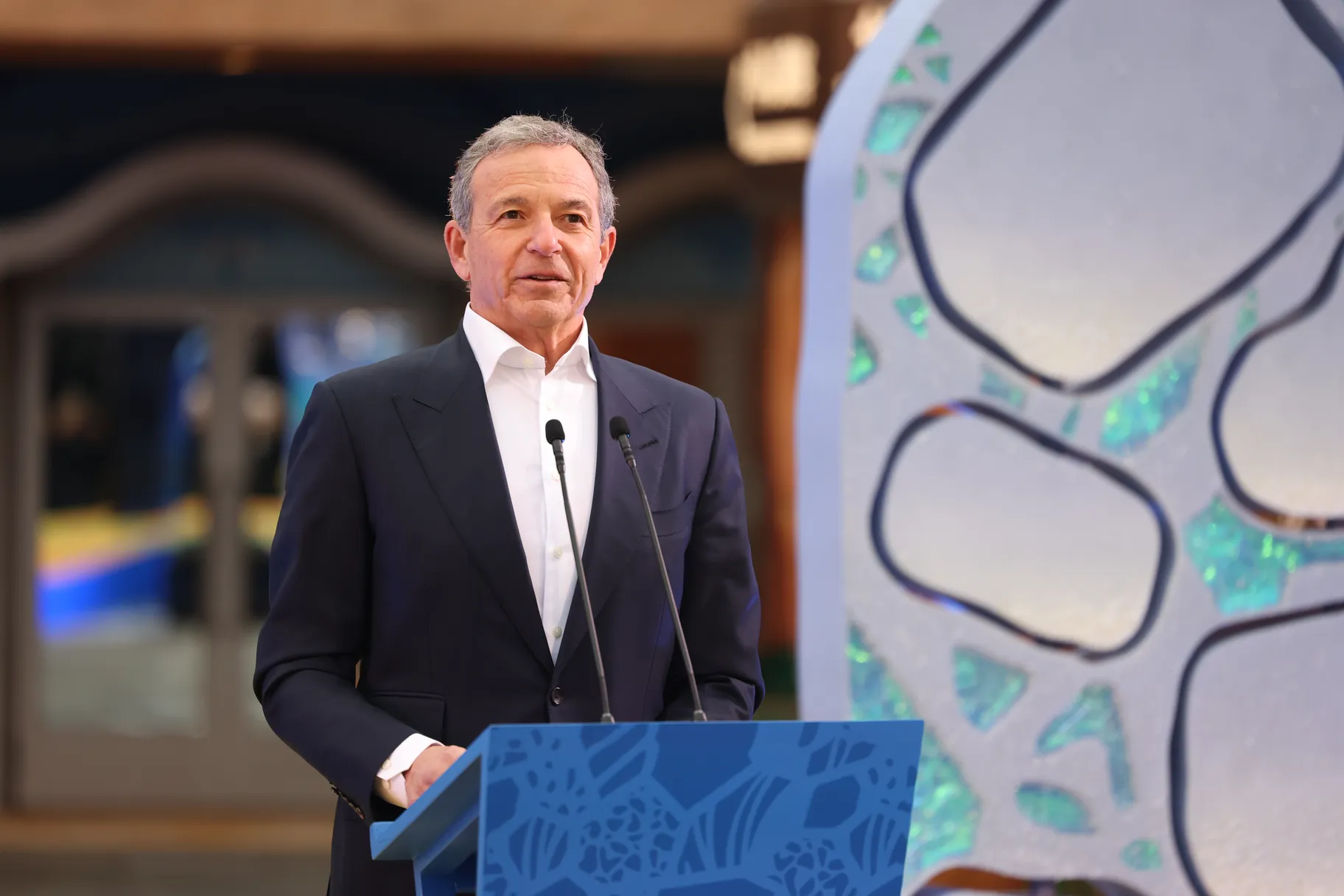

Bob Iger, CEO of The Walt Disney Company, speaks during the grand opening ceremony of Shanghai Disney Resort's Zootopia-themed attraction at Shanghai Disney Resort on December 19, 2023. Photo by VCG/VCG/REUTERS

Disney and Bob Iger

Bob Iger has encountered a litany of problems stacked up since he returned to head The Walt Disney Company about a year ago. Despite his attempts to improve the company’s balance sheet by laying off thousands earlier this year, he was still met with opposition from activist shareholders. He also found its creative studios Marvel and Pixar productions underperforming, and much more.

More: Disney initiates staggered layoffs of 7,000 employees

Will Iger dig himself out of these troubles? Shaw thinks Iger will need several years to solve those problems.

Is there a silver lining? Disney should see improved financial performance out of its streaming business. “The best thing that they will have going for them, which I think could improve the performance of the stock, is they have gotten away with dramatically increasing prices on the streaming side without losing a lot of customers,” Shaw says.

Will that be enough for Wall Street? If the streaming business starts breaking even next year, Shaw asserts, Disney’s stock may start improving.

What could Iger do? Because Iger has been “a deal guy throughout his tenure at Disney,” Belloni believes he will look into creating partnerships.

“I think [Disney] will find some deep-pocketed company, whether it's a tech company or others, to come into ESPN, bulk that up, and help them afford the sports rights that they believe are necessary to help take ESPN over the top,” Belloni says.

He also believes that Disney might get into the video game world and focus on its streaming strategy with Hulu either becoming an app or being integrated as a tile into Disney+ next year.

Will Iger announce a successor? Masters believe he will. “There's so much pressure on him now, he cannot do this thing again, and I doubt he would really want to because he's had such a tough time lately.”

Netflix

After Netflix released a trove of data that included viewership patterns in mid December, its Co-CEO Ted Sarandos plans to share new reports every six months.

More: Netflix reveals viewing data for the first time. What now?

How will the data affect Netflix next year? Shaw doesn’t think it changes much for the streamer because they already had access to this information.

However, this could impact the public's perception. “Twice a year, there will be a reminder of what works and also, by the way, what doesn't work,” Shaw says.

How will this impact deals made with creatives? For Shaw, “what doesn’t work” is the bigger issue. “You're going to have a lot of folks who made stuff get exposed for how little it gets watched, or how it's the fact that it's like the 150th most popular idol on Netflix. Guess what that means? You're not getting your 20% salary raise in season three.”

Belloni has another take on the rationale on why Netflix is doing this.

“For most of its existence, Netflix has paid creators as if their shows are hits. They pay them their quotes plus a premium to buy out their back end,” he explains.

With the numbers, Netflix will pull back from that model and show exactly what’s driving viewership. Then, the streamer will only pay 20% premiums if a show is “in the top 1000.”

“This is the power position that Netflix is in right now because they are uniquely able to create global hits,” Belloni says. “So they're going to start to leverage that power. And I think you're going to see the squeeze put onto creatives.”

CAA and Endeavor

French billionaire François-Henri Pinault acquired a majority stake in the talent agency CAA from TPG. He paid $7 billion for the deal.

What lies ahead for CAA after this deal? One of the biggest issues is how the money will get split, Master says. “There's a huge windfall for the top people, and then the other people [below] are like, ‘What about us?’

This creates big tensions because people have invested in CAA, so they have a stake in how the agency does, Belloni explains. However, because this was not a company sale, “a lot of those people that were expecting some big payday from this $7 billion valuation of CAA are not getting it.”

What happens to the unhappy managers? They don’t have many options, Shaw says, citing that they can start their own management company, go to Endeavor or UTA.

“I’m sure they’d be thrilled,” Masters points out. “We already know that Ari Emmanuel [CEO of Endeavor] has been dialing people.”

What happens to Endeavor next year? Its CEO Ari Emmanuel might take the company private because the stock balance the agency was expecting after it acquired WWE, didn’t pan out. “This past year, they spun that off into this new company TKO that endeavor owns 51% of, and the stock did not respond. And the narrative on Wall Street has not been what Ari thinks it's valued,” Belloni explains.

Masters: I think maybe there's some misgivings on the part of Silverlake big investors about what kind of a CEO of a public company Ari is, you know, now he's in the sack through TKO with some really unappealing people.

How will its investors react? Shaw believes Silverlake may be questioning whether Emmanuel is “the right leader for the organization.”

“You look at this business, and they took it public and it hasn't performed,” Shaw says. “They've given him a lot of money and a lot of leeway over the years to buy things, and he's been very successful at building this empire, but was not successful at convincing investors to value it at what it probably should be worth.”

Masters believes there may be “change in the wind.” “I sense the restlessness, even within the agency… [and] I feel like there is a little bit [of], ‘Okay, he did the thing, it didn't pay off that well, and maybe now we can look at a new leadership.’”

Key predictions for 2024

- Masters predicts that something big will happen at Paramount next year.

- Belloni believes that the domestic box office will fall below $8 billion.

- And Shaw, Lucas forecasts that the TV ad market will get worse, not better.